Following one of the shortest legislative sessions in nearly 40 years, the Kansas Legislature adjourned at 2:05 AM on Saturday, May 3rd. In 2014, the Kansas Association of REALTORS® (KAR) took a major step forward to stimulate the Kansas real estate market and reduce the tax burden on Kansas property owners by repealing the century-old mortgage registration tax and passing major property tax reform measures.

Following one of the shortest legislative sessions in nearly 40 years, the Kansas Legislature adjourned at 2:05 AM on Saturday, May 3rd. In 2014, the Kansas Association of REALTORS® (KAR) took a major step forward to stimulate the Kansas real estate market and reduce the tax burden on Kansas property owners by repealing the century-old mortgage registration tax and passing major property tax reform measures.

When 7,500 Kansas REALTORS® stand together with one unified voice, we deliver a clear and effective message to the Kansas Capitol that the real estate industry is critical to the Kansas economy and that property ownership continues to be an essential component of the American Dream. Thank you for your assistance and for continuing to be a valuable member of the REALTOR® Party by supporting the REALTORS® PAC (RPAC) with your generous investments and lending your voice to our advocacy efforts at the Kansas Capitol and in the United States Congress.

KANSAS REALTOR® LEGISLATIVE AGENDA: TOP PRIORITIES

1. Lowering the Tax Burden on Property Owners by Repealing the Mortgage Registration Tax and Becoming the First State to Ever Repeal an Existing Real Estate Transfer Tax – SIGNED BY GOVERNOR

- In 2014, KAR and a coalition of agriculture, banking and business groups helped pass legislation (HB 2643) to make Kansas the 15th state in the nation to have no real estate transfer taxes on the purchase or sale of real property. In fact, we helped make Kansas the first state in the nation to ever repeal an existing real estate transfer tax.

- Beginning on January 1, 2015, the current 0.26% mortgage registration tax will be phased out over a five-year period. In future years, the phase-out will resulting in the following reductions in the tax rate:

– After January 1, 2015, the tax rate will drop to 0.20%;

– After January 1, 2016, the tax rate will drop to 0.15%;

– After January 1, 2017, the tax rate will drop to 0.10%;

– After January 1, 2018, the tax rate will drop to 0.05%; and

– After January 1, 2019, the tax rate will drop to zero and the tax will be completely eliminated.

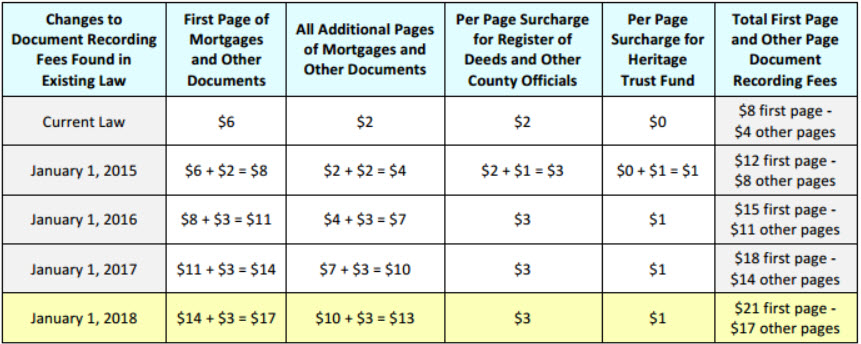

- In order to ensure that counties have all the funding needed to record mortgages and other real estate-related documents, document recording fees will be increased in phases over a four-year period, which will result in the following document recording fees:

- In order to ensure that lower-income borrowers are not burdened by the increased document recording fees, the new law establishes a $125 cap on the total document recording fees that will be paid by a homeowner for all residential mortgage loans of less than $75,000 in value. If a homeowner files a mortgage that is valued at less than $75,000, they will never pay more than $125 to file their mortgage documents.

- When the new law is fully implemented in 2019, it will cost the average Kansas property owner with a $178,000 mortgage around $270 less to file their documents with their county’s Register of Deeds, which is a 51% savings. For larger commercial mortgages, which are generally refinanced and filed every three to five years, the cost savings will be around $2,400 or around 90% for each transaction.

2. Requiring Local Governments to be More Accountable and Transparent When They Increase Property Taxes through Assessed Valuation Growth on Existing Properties – SIGNED BY THE GOVERNOR

- Following five years of discussions with legislators, KAR was finally able to pass legislation (HB 2047) this year that will make local governments more accountable and transparent to property taxpayers when property taxes are increased through the assessed valuation growth of existing properties.

- Over the last 16 years, total property tax revenues collected by local governments have more than doubled from around $775 million in 1997 to just under $1.7 billion in 2013. Unfortunately, Kansas cities and counties increase the property tax burden on property owners by an average of 7% each year.

- Roughly 80% of this growth in property tax revenues results from growth in assessed valuations on existing properties. As a result, the only long-term solution to our property tax problems is to make it more difficult for local governments to collect increased property tax revenues each year from assessed valuation growth.

- Under our legislation, all local governments that increase property taxes through assessed valuation growth will be forced to publish a notice in the newspaper informing their constituents that their property taxes are increasing. In addition, each local government will be forced to specifically approve the property tax increase through a majority vote of the governing body. This will help put the spotlight on increasing property taxes and assessed valuations.

3. Reforming the Property Tax Appeals System and the Court of Tax Appeals (COTA) to Increase the Fairness and Predictability for Kansas Property Owners – SIGNED BY GOVERNOR

- Moreover, KAR was able to work with a coalition of business groups to pass legislation (SB 231) that will make it much easier for Kansas families, farmers and small business owners to appeal their property tax valuations. Over the past several years, KAR has fielded many complaints from Kansas property owners and REALTORS® that the property tax appeals process is costly, time-consuming and unfair to property owners.

- Among other things, this legislation will reform the property tax appeals process by:

– Making it easier for constituents to bring an appeal in front of the Board of Tax Appeals (BOTA) and allowing non-attorneys to represent property owners in front of BOTA;

– Requiring the county appraiser to set the valuation of a taxpayer’s property at the amount established in an appraisal prepared for the taxpayer by a licensed real estate appraiser. If the county appraiser refuses to accept the property’s value as established in the appraisal, they will have the burden to prove that the taxpayer’s

proposed valuation is wrong in the BOTA hearing; and

– When a taxpayer successfully appeals the valuation of his or her property to BOTA, our legislation will provide a two-year safe harbor period where the county appraiser is prohibited from increasing the valuation of the property unless the taxpayer has significantly renovated or changed the use of the property.

4. Protecting Your Business and Clients by Defeating Radon Testing Mandates and Protecting the Ability of Real

Estate Licensees to Accept and Pay Referral Fees – BILLS DEFEATED

- Just like previous sessions, KAR continues to defeat legislation that would impose burdensome and unnecessary mandates on your business or clients. For example, KAR again defeated legislation (SB 115) this session that would have required a mandatory test for radon gas in all residential real estate transactions. As a result, your clients will continue to have the freedom to choose whether to pay for a radon gas test in each real estate transaction.

- In addition, KAR defeated legislation (SB 116) this session that would have prohibited real estate licensees from accepting or paying referral fees to other real estate licensees. This burdensome legislation would have been an unnecessary intrusion into your real estate business and would have created a significant disincentive for real estate licensees to refer business to other real estate licensees.