The last week of February, legislation to protect Kansans’ ability to deduct mortgage interest on their state taxes, advanced again at the Statehouse. SB 22, which contains these critical provisions, passed out of the House Taxation Committee and is one step closer to reaching the Governor’s desk.

The 2017 Federal tax reforms doubled the standard deduction for Federal Income Taxes. Kansas requires taxpayers who take the federal standard deduction to also take the standard deduction at the state level. As a result, anyone who takes the higher federal standard deduction is unable to claim charitable, medical, mortgage interest or property tax deductions. Homeowners, who have historically benefited from these deductions, will end up paying more state income tax.

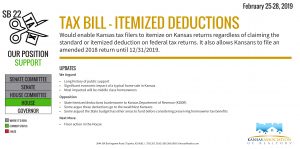

The Kansas Association of REALTORS® is working to pass legislation enabling Kansans to keep these deductions. The legislation would remove the itemization restrictions. Additionally, it would allow filers to take the itemized deduction in 2018, giving them until December 31, 2019 to file amended 2018 returns.

Since 2012, the Kansas Legislature has acted to preserve Kansans’ ability to claim these deductions on state income tax returns.

Hundreds of thousands of Kansans take advantage of these tax deductions every year.

In 2016:

- 247,110 claimed the mortgage interest deduction

- 307,420 claimed the real estate property tax deduction

- 281,250 claimed the charitable contributions deductions.

Of those that took the deductions in 2016, about half had adjusted gross incomes of less than $100,000.

Housing provides significant return on investment for Kansas. The real estate industry accounted for more than $24 billion, or 15.4% of the Kansas economy. Home sales generate income from construction costs, brokerage fees, inspection costs, mortgage lending and insurance. This income is re-circulated into the economy. The National Association of REALTORS® estimates the sale of a median priced home in Kansas has $61,095 impact on the economy.[1]

SB 22 is a package of tax provisions. Unrelated aspects of the tax legislation include:

- Business taxes on revenue from foreign assets

- Reducing the percentage of sales tax on food

- Sales tax collection from out-of-state retailers

For more information about the bill and its impact, visit protectthededuction.com.

[1] Copyright © 2017 “Economic Impact of a Home Sale in Kansas.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. January 25,2019, https://www.nar.realtor/sites/default/files/documents/2019-01-State-Economic-Impact-KS-01-08-2019.pdf