On October 15th, advance voting began for the 2014 General Election. The Kansas REALTORS® PAC (RPAC) urges you to take this opportunity to vote! In order to help you make an informed choice, Kansas RPAC publishes this voting guide to provide you with … [Read more...]

Advance Voting Begins: Kansas RPAC Makes Endorsements for the 2014 General Election

Kansas REALTORS® PAC Supports REALTOR® Party Champions in the 2014 Primary Election

During the 2014 Primary Election, the Kansas REALTORS® PAC has endorsed and provided financial support to many candidates that have championed REALTOR® Party issues in the Kansas Legislature and Congress. Become informed on the candidates, download … [Read more...]

Kansas REALTORS® PAC & National REALTORS® PAC Endorse Senator Pat Roberts for Reelection

The Kansas REALTORS® PAC, the state’s largest association political action committee representing over 7,600 real estate professionals working in the agricultural, commercial and residential real estate industries, enthusiastically endorses Senator … [Read more...]

Does the repeal of the mortgage tax only apply to residential sales?

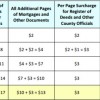

The mortgage registration tax previously applied to mortgage documents filed on all types of real property. As a result, the phase-out of the mortgage registration tax over a five-year period beginning on January 1, 2015 will apply equally to all … [Read more...]

Review of the 2014 Legislative Session

Following one of the shortest legislative sessions in nearly 40 years, the Kansas Legislature adjourned at 2:05 AM on Saturday, May 3rd. In 2014, the Kansas Association of REALTORS® (KAR) took a major step forward to stimulate the Kansas real estate … [Read more...]

Local Association Promotes RPAC with Video

The Topeka Area Association of REALTORS® is excited to announce this year's activities through this fun video. Their Governmental Affairs committee members have been hard at work organizing this years RPAC events and wanted to share the events with … [Read more...]

NAR Opposes Federal Tax Reform Proposal that Would Harm Residential and Commercial Property Owners

Last week, an influential member of Congress introduced a federal tax reform proposal that would, among other things, eliminate the ability of homeowners to claim the property tax deduction, limit the mortgage interest deduction, increase the capital … [Read more...]

2014 Legislative Agenda for the Kansas Association of REALTORS®

Now more than ever, the return of a healthy real estate market and real estate industry is vital to restoring strong economic development and job growth in Kansas. The real estate industry plays a unique and major role in stimulating economic growth … [Read more...]

NAR Issue Update Mortgage Cancellation Tax Relief

Issue Background: On December 31, 2013 the Mortgage Cancellation Tax Relief will expire. NAR has been working with Congress since early this year to extend this important real estate tax provision. Without an extension, homeowners who have any … [Read more...]

Kansas REALTORS® Pushing for Property Tax Reform for Kansas Families, Farmers and Small Businesses in 2014

BACKGROUND ON THE ISSUE: During the 2014 Legislative Session, Kansas REALTORS® will again push legislation to provide relief to Kansas families, farmers and small business owners from the crushing property tax burdens imposed by Kansas local … [Read more...]